UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐ Check the appropriate box:

Medicine Man Technologies, Inc. (Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

☒ | No fee required. | ||||||||

| |||||||||

| |||||||||

Fee paid previously with preliminary materials. | |||||||||

☐ | |||||||||

Fee computed on table in exhibit required by Item 25(b) per Exchange Act | |||||||||

| |||||||||

MEDICINE MAN TECHNOLOGIES, INC.

( d/b/a Nevada corporation)

Notice of Annual Shareholder Meeting

and

Proxy Statement

SCHWAZZE

MEDICINE MAN TECHNOLOGIES, INC.

4880 Havana Street,

Suite 201

Denver, Colorado 80239

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 8, 2017

To be Held December 15, 2022

To our Stockholders:the Stockholders of Medicine Man Technologies, Inc.:

On behalf of our Board of Directors, I cordially invite you to attend our 2017NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders. This meetingStockholders (the “Annual Meeting”) of Medicine Man Technologies, Inc., a Nevada corporation doing business as Schwazze (the “Company”), will be held at our principal place of business located9 a.m. local time on December 15, 2022, or such later date or dates as such Annual Meeting may be postponed or adjourned, at 4880 Havana St.,Street, Suite 201, Denver CO 80239 on Saturday, June 3, 2017, at 10:00 a.m., local time. Duringfor the meeting, we will discuss the itemspurpose of business described in the accompanying Notice of Annual Meetingconsidering and Proxy Statement, update you on important developments in our business and respond to any questions that you may have about us.

Information about the matters to be acted upon at the meeting is contained in the accompanying Notice of Annual Meeting and Proxy Statement. Included with this Proxy Statement please find your proxy card instructions for voting. You are being asked to elect directors, ratify the appointment of our auditors and conduct any other business properly raised at the meeting or any adjournments or postponements thereof.

Your vote is very important. Please take a moment now to cast your vote whether or not you plan to attend the meeting by completing, signing, dating and returning the enclosed proxy using the enclosed self-addressed, stamped envelope. You may still vote in person at the meeting, even if you return a proxy.

I look forward to seeing you at the meeting.

|

MEDICINE MAN TECHNOLOGIES, INC.

4880 Havana Street

Suite 201

Denver, Colorado 80239

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD SATURDAY, JUNE 3, 2017

|

To the Shareholders of MEDICINE MAN TECHNOLOGIES, INC.

Pursuant to the Company’s Bylaws, please take notice that an Annual Meeting of Shareholders of Medicine Man Technologies, Inc. will be held at 4880 Havana St., Suite 201, Denver, Colorado 80239 on Saturday, June 3, 2017, at 10:00 a.m. local time and votetaking action on the following matters:

proposals:

| To ratify the appointment of BF Borgers, CPA |

| ● | To transact any other business properly brought before the meeting. |

The foregoing business items are more fully described in the following pages, which are made part of this notice.

The Company’s Board of Directors recommends that you vote as follows:

May 1, 2017,The Company’s Board of Directors has been fixed the close of business on October 28, 2022 as the record date (the “Record Date”) for the determination of the shareholdersstockholders entitled to notice of and to vote at the meetingAnnual Meeting and only holdersat any adjournments or postponements thereof. You may vote if you were the record owner of shares of Commonthe Company’s common stock or Series A Cumulative Convertible Preferred Stock of record at the close of business on that day will bethe Record Date.

As of the Record Date, there were 54,741,506 shares of common stock and 86,050 shares of Series A Cumulative Convertible Preferred Stock outstanding and entitled to vote. A list of stockholders of record will be available at the Annual Meeting and, during the 10 days before the Annual Meeting, at the office of the Secretary of the Company at 4880 Havana Street, Suite 201, Denver, CO 80239.

This year, we have elected to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. Accordingly, we are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to many of our stockholders instead of paper copies of our proxy statement and 2021 Annual Report. The stock transfer books will not be closed.

Notice contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how stockholders can receive a paper copy of our proxy materials, including this proxy statement, our 2021 Annual Report, and proxy card.

All shareholdersstockholders are cordially invited to attend the meeting. To insureAnnual Meeting. Whether you plan to attend the Annual Meeting or not, you are requested to complete, sign, date and return the enclosed proxy card, or respond via Internet or telephone, as soon as possible in accordance with the instructions on the proxy card and the Notice. A pre-addressed, postage prepaid return envelope is enclosed for your representationconvenience.

These proxy materials are also available via the Internet at www.proxyvote.com. You are encouraged to read the proxy materials carefully in their entirety and submit your proxy as soon as possible so that your shares can be voted at the meeting, please complete and promptly mailAnnual Meeting in accordance with your proxy, which is solicited by the Board of Directors, in the return envelope provided. If desired, you may also complete your proxy card, scan it as a PDF or JPEG file, and send it to MDCL-ASM-2017@medicinemantechnologies.com no later than Saturday, June 3, 2017. Submission of your proxy by mail or email will not prevent you from voting in person, should you so desire, but will help to secure a quorum and avoid added solicitation costs.instructions.

Dated: November 1, 2022 | By Order of the Board of Directors of Medicine Man Technologies, Inc. d/b/a Schwazze |

|

|

| Sincerely, |

| |

|

|

| Justin Dye |

| Chief Executive Officer and |

| Executive Chairman of the Board |

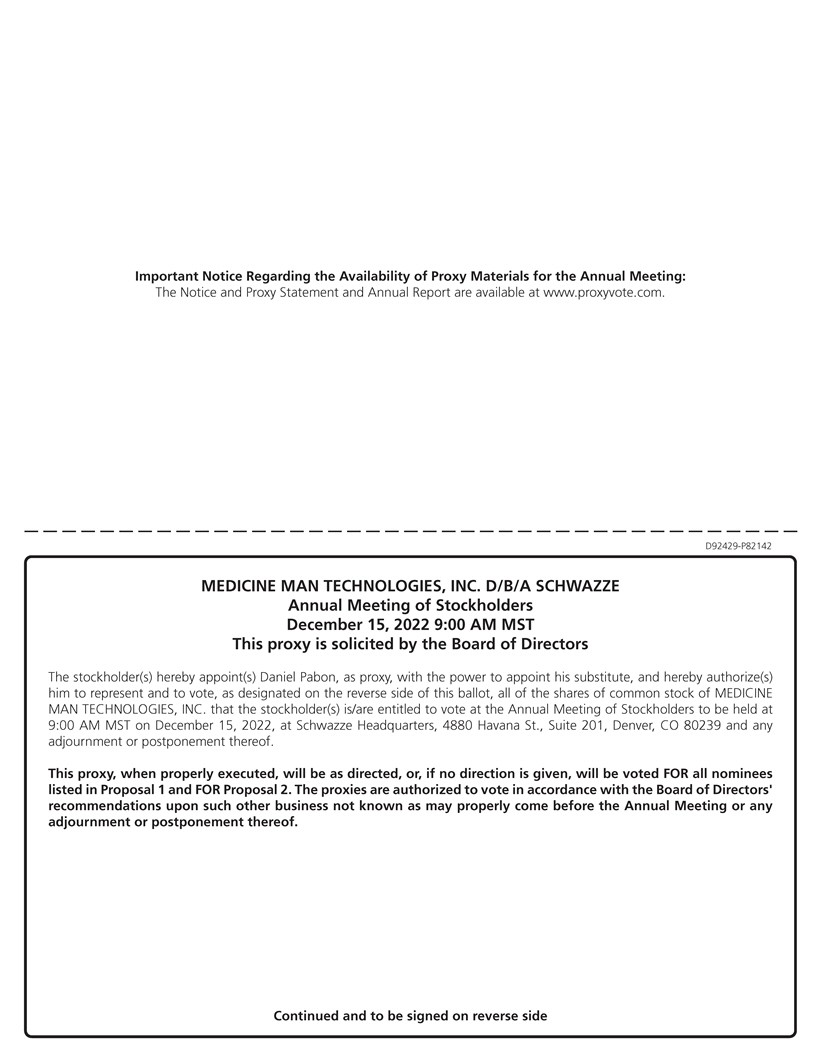

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 15, 2022:

The Notice of Internet Availability of Proxy Materials, Notice of Meeting,

Dated: May 8, 2017and Proxy Statement are available free of charge at:

WWW.PROXYVOTE.COM

YOUR VOTE AT THE ANNUAL MEETING IS IMPORTANT

Your vote is important. Please datevote as promptly as possible even if you plan to attend the Annual Meeting.

For information on how to vote your shares, please see the Notice and signinstruction from your broker or other fiduciary, as applicable, as well as “General Information About the Annual Meeting” in the proxy statement accompanying Proxy Cardthis notice.

We encourage you to vote by completing, signing, and either mail or emaildating the proxy card, and returning it promptly in the enclosed envelope, or tosubmitting your vote via the email address provided hereinInternet.

Votes not received via mail or email by Saturday, June 3, 2017 will be considered to be non-timely and may,If you have questions about voting your shares, please contact our Corporate Secretary at the determination of the Chairperson not be included for consideration

Medicine Man Technologies, Inc., at 4880 Havana Street, Suite 201, Denver, CO 80239, telephone number (303) 371-0387.

If you decide to change your vote, you may revoke your proxy in the manner described in the attached proxy statement at any time before it is voted.

We urge you to review the accompanying materials carefully and to vote as promptly as possible.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY STATEMENT

MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERSSTOCKHOLDERS TO BE HELD ON DECEMBER 15, 2022 AT 9 A.M. LOCAL TIME.

The Notice of Annual Meeting of Stockholders, our Proxy Statement and our 2021 Annual Report are available at: www.proxyvote.com.

Page | |

1 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 7 |

12 | |

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE | 14 |

22 | |

23 | |

27 | |

33 | |

34 |

i

To Be Held Saturday, June 3, 2017

MEDICINE MAN TECHNOLOGIES, INC. d/b/a SCHWAZZE

4880 Havana Street, Suite 201

Denver, Colorado 80239

PROXY STATEMENT

2022 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 15, 2022

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This Proxy Statement is furnished in conjunctionproxy statement, along with the solicitationaccompanying notice of the 2022 Annual Meeting of Stockholders (the “Notice”), contains information about the 2022 Annual Meeting of Stockholders of the Company, including any adjournments or postponements thereof (referred to herein as the “Annual Meeting”). We are holding the Annual Meeting at 9:00 a.m. local time on December 15, 2022, at 4880 Havana Street, Suite 201, Denver CO 80239, or such later date or dates as such Annual Meeting date may be adjourned or postponed. For directions to the meeting, please call (303) 371-0387.

This proxy statement has been prepared by the Company’s management and it solicits proxies by and on behalf of the Company’s Board of Directors (referred to herein as the “Board of Directors” or the “Board”).

This proxy statement and the other proxy materials for the Annual Meeting also are available via the Internet at www.proxyvote.com. You are encouraged to read the proxy materials carefully, and in their entirety, and submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Even if you plan to attend the Annual Meeting, you are encouraged to submit your vote promptly. You have a choice of submitting your proxy by Internet, by telephone or by mail, and the Notice and the proxy card provides instructions (and access number) for each option.

In this proxy statement, we refer to Medicine Man Technologies, Inc., a Nevada corporation (the “Company”),doing business as Schwazze, as the “Company,” “we,” “us” or “our.”

We are mailing the Notice and/or this proxy statement, as applicable, beginning on or about November 1, 2022.

Why Did You Send Me This Proxy Statement?

The Board of Directors is soliciting proxies, in the accompanying form, to be used at the Company’s Annual Meeting of Shareholders (the “Meeting”) to be held on Saturday, June 3, 2017, at 10:00 a.m. at 4880 Havana St., Suite 201, Denver, Colorado 80239, and at any adjournments or postponements thereof.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What will stockholders be voting on This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Meeting?

Annual Meeting. At the Annual Meeting, you will be asked to vote on the following proposals:

| To ratify the appointment of BF Borgers, CPA |

| To transact |

1

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on December 15, 2022: The Notice of Annual Meeting of Stockholders, our Proxy Statement and our 2021 Annual Report are available at www.proxyvote.com.

Who isThe following documents are being made available to all stockholders entitled to notice of and to vote at the MeetingAnnual Meeting:

| 1) | This proxy statement. |

| 2) | The accompanying proxy. |

| 3) | Our 2021 Annual Report. |

The 2021 Annual Report includes our financial statements for the fiscal year ended December 31, 2021 but is not a part of this proxy statement. You can also find a copy of our 2021 Annual Report on Form 10-K, as amended by our Annual Reports on Form 10-K/A, on the Internet through the Securities and how many votes do they have?Exchange Commission’s (“SEC”) electronic data system called EDGAR at www.sec.gov/edgar or through the “SEC Filings” section of our website at https://ir.schwazze.com/sec-filings/all-sec-filings.

Who Can Vote?

Common stockholdersStockholders who owned shares of recordour common stock or shares of our Series A Cumulative Convertible Preferred Stock (the “Series A Preferred Stock”) at the close of business on the Record Date, May 1, 2017, mayOctober 28, 2022 (the “Record Date”), are entitled to vote at the Annual Meeting. Each share of Common Stock has one vote. There were 10,558,087 sharesHolders of our Commoncommon stock and Series A Preferred Stock outstanding on the Record Date.

What percentage of our Common Stock do the directors and executive officers own?

Our Board of Directors owns 17.9 % of our issued and outstanding shares of Common Stock in the aggregate,

How do I vote?

vote together as a single class.

You must be present, or represented by proxy, atdo not need to attend the Annual Meeting in order to vote your shares. EvenShares represented by valid proxies received in time for the Annual Meeting and not revoked prior to the Annual Meeting will be voted at the Annual Meeting. A stockholder may revoke a proxy before the proxy is voted by following the instructions included below under “May I Change or Revoke My Proxy?”

How Many Votes Do I Have?

Each share of common stock that you own entitles you to one vote. Each share of Series A Preferred Stock that you own entitles you to cast a number of votes equal to the number of whole shares of common stock into which the share of Series A Preferred Stock would convert into as of the Record Date as if such share of Series A Preferred Stock were convertible as of such date. Each share of Series A Preferred Stock is convertible into the number of share(s) of common stock determined by dividing (i) the Series A Preferred Stock preference amount (which includes accrued dividends) plus the pro rata portion of the amount of the next dividend for the period between the previous dividend payment date and the date of determination, by (ii) $1.20.

As of the Record Date, there were 54,741,506 shares of common stock and 86,050 shares of Series A Preferred Stock outstanding and entitled to vote. The shares of Series A Preferred Stock outstanding as of the Record Date are entitled to cast an aggregate of 82,487,530 votes. The 441,247 shares of common stock that are held in escrow under the applicable acquisition agreements entered into with certain sellers and the 944 shares of Series A Preferred Stock that are held in escrow under the asset purchase agreements entered into with the Star Buds Companies are not outstanding as of the Record Date nor entitled to vote at the Annual Meeting.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we encourageurge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares by proxy. Since we expect that manyshould be voted for or withheld for each nominee for director, and how your shares should be voted with respect to each of our common stockholders will be unable to attend the Meeting in person, we sendother proposals. Except as set forth below, if you properly submit a proxy cards to all of our common stockholders to enable them to vote either by direct mail, email submission, or via electronic means.

What is a proxy?

A proxy is a person you appoint to vote on your behalf. If you complete and return the enclosed proxy card,without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend

2

the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Globex Transfer, LLC, you may vote:

| ● | By mail. Complete and mail the proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card, but do not specify how you want your shares voted, they will be voted as recommended by the Board. |

| ● | By Internet. At www.proxyvote.com by following the instructions provided in the Notice. |

| ● | In person at the meeting. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. |

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| ● | By Internet or by telephone. Follow the instructions you receive from your bank, broker or other nominee to vote by Internet or telephone. |

| ● | By mail. You will receive instructions from your bank, broker or other nominee explaining how to vote your shares. |

| ● | In person at the meeting. Contact the bank, broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting. You will not be able to attend the Annual Meeting unless you have a proxy card from your bank, broker or other nominee. |

How Does the Board Recommend That I Vote On the Proposals?

The Board recommends that you vote as follows:

| ● | “FOR” for the election of Messrs. Berger, Cozad, Garwood, Montalbano, and Wahdan as Class A directors of the Board; and |

| ● | “FOR” ratification of the selection of BF Borgers, CPA P.C. as our independent public accountant for the fiscal year ending December 31, 2022. |

If any other matter is presented, the proxy card provides that your shares will be voted by the proxies identifiedproxy holder listed on the proxy card.

By completing and returningcard in accordance with his or her judgment if permitted by applicable law. As of the date of this proxy card, who amstatement, we are not aware of any other matters that need to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I designating as my proxy?Change or Revoke My Proxy?

You will be designating Andrew Williams, our Chief Executive Officer as your proxy. He may act on your behalf and will have the authority to appoint a substitute to act as proxy.

How will my proxy vote my shares?

Your proxy will vote according to the instructions onIf you give us your proxy, card.

We do not intend to bring any other matter for a vote at the Meeting, and we do not know of anyone else who intends to do so. However, your proxies are authorized to vote on your behalf, in their discretion, on any other business that properly comes before the Meeting or any adjournments or postponements thereof.

How do I vote using my proxy card?

Simply complete, sign and date the enclosed proxy card and return it in the postage-paid, self-addressed envelope provided or via email (PDF or JPEG format attachment) to MDCL-ASM-2017@medicinemantechnologies.com.

How do Iyou may change or revoke my proxy?

it at any time before the Annual Meeting. You may change or revoke your proxy atin any time before your shares are voted atone of the Meeting by:

following ways:

| submitting it as instructed above, re-voting via telephone as instructed above, or re-voting via the Internet by following the instructions in the Notice; |

| if your shares are held in street name, re-voting by Internet or by telephone as instructed above – only your latest Internet or telephone vote will be counted; |

| ● | if your shares are registered in your name, notifying the Company’s Corporate Secretary in writing |

3

| ● | attending the Annual Meeting and voting in person. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy unless you specifically request it. |

What If I Receive More Than One Proxy Card?

You may receive more than one proxy card or voting instruction form if you hold shares of our common stock or Series A Preferred Stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above or on the proxy card for each account to ensure that all of your shares are voted.

Will My Shares Be Voted If I Do Not Return My Proxy Card?

If your shares are registered in your name, they will not be voted if you do not return your proxy card by ballot in personmail or vote at the Meeting.

Attendance atAnnual Meeting as described above under “How Do I Vote?” If your bank, broker or other nominee cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter, or because your bank, broker or other nominee chooses not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.” The New York Stock Exchange (“NYSE”) has rules that govern bank, broker or other nominee who have record ownership of listed company stock (including stock such as ours that is quoted on the Meeting willOTCQX) held in brokerage accounts for their clients who beneficially own the shares. Under these rules, bank, broker or other nominee who do not itself revokereceive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“routine matters”), but do not have the discretion to vote uninstructed shares as to certain other matters (“non-routine matters”). Under NYSE interpretations, Proposal 1 (election of directors) is considered a proxy. All signed proxiesnon-routine matter, and Proposal 2 (ratification of our independent public accountant) is considered a routine matter. If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” the bank, broker or other nominee has the authority, even if it does not receive instructions from you, to vote your unvoted shares for Proposal 2 (ratification of our independent public accountant) but does not have not been revokedauthority to vote your unvoted shares for Proposal 1 (election of directors). We encourage you to provide voting instructions. This ensures your shares will be voted at the Meeting. If yourAnnual Meeting in the manner you desire.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy contains any specific instructions, they will be followed.materials instead of a full set of proxy materials?

Who will count the votes?

An inspector of election designatedPursuant to rules adopted by the BoardSEC, the Company will countuse the votes.Internet as the primary means of furnishing proxy materials to stockholders. Accordingly, the Company is sending a Notice to the Company’s stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the complete proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its annual meetings and the cost to the Company associated with the physical printing and mailing of materials.

How can I get electronic access to the proxy materials?

The Notice explains how to:

| ● | view the Company’s proxy materials for the Annual Meeting on the Internet; and |

| ● | instruct the Company to send future proxy materials to you by email. |

The Company’s proxy materials are also available on the Company’s website at www.ir.schwazze.com.

4

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Class B Directors | ||

Proposal 1: Election of Jonathan Berger, Jeffrey Cozad, Jeffrey Garwood, Paul Montalbano, and Salim Wahdan as Class A Directors | The affirmative vote of a majority of the shares present and entitled to vote at a meeting of stockholders at which a quorum is present is necessary to approve the election of directors, with the holders of our common stock and the holders of our Series A Preferred Stock (which vote on an as-converted-to-common-stock basis) voting together as a single class. You may vote FOR or AGAINST any of the nominees or ABSTAIN from voting on any of the nominees. Banks, brokers or other nominees do not have authority to vote customers’ unvoted shares held by them in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Abstentions and broker non-votes with respect to any of the nominees will have the effect of a vote AGAINST that nominee. | |

Proposal 2: Ratification of the Appointment of BF Borgers, CPA P.C. as our Independent Public Accountant for the Fiscal Year Ending December 31, 2022 | The affirmative vote of a majority of the shares of stock present and entitled to vote at a meeting of stockholders at which a quorum is present is necessary to ratify the appointment of the Company’s independent public accountant, with the holders of our common stock and the holders of our Series A Preferred Stock (which vote on an as-converted-to-common-stock basis) voting together as a single class. You may vote FOR or AGAINST this proposal or ABSTAIN from voting on this proposal. Abstentions will have the same effect as a vote AGAINST this proposal. Banks, brokers or other nominees have authority to vote customers’ unvoted shares held by them in street name on accountant ratification proposals. If a bank, broker or other nominee does not exercise this authority, it will result in broker non-votes and such broker non-votes will have the same effect as a vote AGAINST this proposal. We are seeking the approval of our stockholders to appoint the Company’s independent accountant in an effort to maintain sound corporate governance practices. If our stockholders do not ratify the appointment of BF Borgers, CPA P.C. as the Company’s independent public accountant for the fiscal year ending December 31, 2022, the Audit Committee of the Board may reconsider its appointment based upon such feedback but is not required to do so. | |

| | |

What constitutesConstitutes a quorum?Quorum for the Annual Meeting?

A quorum, which is necessary to conduct business at the Meeting, constitutesThe presence, in person, by means of electronic communication, or by proxy, of a majority of the outstandingaggregate number of shares of our Common Stockeach class of capital stock outstanding and entitled to be castvote at the Annual Meeting present in person or represented by proxy. If you sign and return your proxy card, your shares will be counted in determining the presence ofis necessary to constitute a quorum even if you withhold your vote or abstain from voting. If a quorum is notat the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting the Chairman of the Meeting or the stockholders present in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Householding of Annual Disclosure Documents

The SEC previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or banks, brokers or other nominees holding our shares on your behalf to send a single mailing containing our annual report and proxy statement to any household at which two or more of our stockholders reside if either we or the banks, brokers or other nominees believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both stockholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once stockholders receive notice from their banks, brokers or other nominees or from us that communications to their addresses will be “householded,” the practice will continue until stockholders are otherwise notified or until they revoke their consent to the practice. Each stockholder will continue to receive a separate proxy card or voting instruction card.

5

Those stockholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our stockholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:

| ● | Stockholders whose shares are registered in their own name should contact our transfer agent, Globex Transfer, LLC, 780 Deltona Blvd., Suite 202, Deltona, FL 32725 telephone: (813) 344-4490. |

| ● | Stockholders whose shares are held by a bank, broker or other nominee should contact such bank, broker or other nominee directly and inform them of this request. Stockholders should be sure to include their name, the name of their brokerage firm and their account number. |

Who is paying for this proxy solicitation?

We will bear the cost of preparing, printing, assembling and mailing the Notice, accompanying proxy card, this proxy statement, as applicable, and other material furnished to stockholders in connection with the solicitation of proxies. In addition to mailed proxy materials, our directors, officers and employees may adjournalso solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the Meetingcost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our Board of Directors submits to stockholders its nominees for election as directors. In addition, the Board of Directors may submit other matters to the stockholders for action at the annual meeting. Stockholders may also submit proposals on matters appropriate for stockholder action at our annual meetings consistent with regulations adopted by the SEC and our amended and restated bylaws (the “Bylaws”).

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, stockholders may present proper proposals for inclusion in our proxy statement for consideration at the 2023 annual meeting of stockholders by submitting their proposals to us in a date nottimely manner. These proposals must meet the stockholder’s eligibility and other requirements of the SEC. To be considered for inclusion in next year’s proxy materials pursuant to Rule 14a-8, you must submit your proposal to our Corporate Secretary in writing by July 7, 2023 if the 2023 annual meeting of stockholders is held on or within 30 days of December 15, 2023. If we elect to hold our 2023 annual meeting of stockholders more than 12030 days before or after December 15, 2023, such stockholder proposals would have to be received a reasonable time before we begin to print and send our proxy materials for the 2023 annual meeting of stockholders.

In addition, under the terms of our Bylaws, stockholders who desire to present a proposal for action or to nominate directors (other than proposals and nominations to be included in our proxy statement pursuant to Rule 14a-8 promulgated under the Exchange Act) at the 2023 annual meeting of stockholders must give written notice, either by personal delivery or by U.S. mail, to our Corporate Secretary no earlier than 90 and no later than 30 calendar days before the date of the 2023 annual meeting of stockholders. Such notice must contain the information required by Section 2.13 of our Bylaws.

All proposals or other notices should be addressed to our Corporate Secretary, 4880 Havana Street, Suite 201 Denver, CO 80239.

If we do not have notice of a proposal or director nomination to come before an annual meeting of stockholders at least 30 calendar days before such annual meeting (unless the annual meeting in question is held more than 30 days before or after the first anniversary of the prior year’s annual meeting of stockholders), your proxy card for such annual meeting will confer discretionary authority to vote on such proposal or nomination. If we elect to hold an annual meeting more than 30 days before or after the first anniversary of the prior year’s annual meeting of stockholders, your proxy for such annual meeting will confer discretionary authority to vote on such proposal or nomination if we do not have notice of such matter a reasonable time before we begin to send our proxy materials for such annual meeting.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, based on 54,741,506 shares of our common stock outstanding as of October 5, 2022 (which excludes treasury stock and certain shares held in escrow or otherwise issuable or releasable in connection with consummated mergers and acquisitions), certain information as to the stock ownership of each person known by us to own beneficially more than five percent or more of our outstanding common stock, of each of the named executive officers included in the Summary Compensation Table below (“NEOs”), of our directors, and of all our current executive officers and directors as a group. In computing the outstanding shares of common stock, we have excluded all shares of common stock subject to options, warrants or other securities that are not currently exercisable or convertible or exercisable or convertible within 60 days of October 5, 2022 and are therefore not deemed to be outstanding and beneficially owned by the person holding the options, warrants or other securities for the purpose of computing the number of shares beneficially owned and the percentage ownership of that person; provided, that we have included shares of common stock underlying such options, warrants or other securities with respect to each person who acquired any such options, warrants or other securities with the purpose or effect of changing or influencing the control of the Company in accordance with Rule 13d-3 promulgated under the Exchange Act. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws. Except as otherwise noted below, the address for persons listed in the table is c/o Medicine Man Technologies, Inc., 4880 Havana Street, Suite 201, Denver, CO 80239.

The shares of common stock issuable upon conversion of shares of our Series A Preferred Stock and our 13% senior secured convertible notes due December 7, 2026 (the “Convertible Notes”) are calculated by including accrued but unpaid dividends and interest, as applicable, as of October 5, 2022 plus dividends and interest, as applicable, accruing during the following 60 days. The table below does not include (i) 441,247 shares of common stock held in escrow in connection with consummated mergers and acquisitions and (ii) shares of common stock issuable upon conversion of 944 shares of Series A Preferred Stock that are held in escrow under the asset purchase agreements entered into with the Star Buds Companies, all of which are neither outstanding as of the Record Date nor entitled to vote at the Annual Meeting.

7

| | | | | |

|

| Number of |

| |

|

| | Shares of | | Percent of |

|

| | Beneficially | | Outstanding |

|

Name of Beneficial Holder | | Owned (A) | | Class |

|

NEOs & Directors | | | | | |

Justin Dye (NEO, Director) (1) |

| 36,757,256 |

| 44.79 | % |

Jeffrey Cozad (Director) (2) |

| 24,810,410 |

| 31.22 | % |

Brian Ruden (Director) (3) |

| 9,846,934 | | 15.27 | |

Salim Wahdan (Director) (4) |

| 1,254,151 | | 2.24 | |

Nirup Krishnamurthy (NEO, Director) (5) |

| 650,000 |

| 1.17 | % |

Daniel Pabon (NEO) (5) |

| 462,500 | | * | |

Jeffrey Garwood (Director) (6) |

| 415,256 | | * | |

Jonathan Berger (Director) |

| 189,631 | | * | |

Pratap Mukharji (Director) (7) |

| 182,101 |

| * | |

Paul Montalbano (Director) | | 94,106 | | * | |

All Executive Officers and Directors as a Group (11 Persons) |

| 75,187,388 |

| 62.86 | % |

|

| |

| | |

5% or greater holders: |

| |

| | |

Dye Capital and Co. (“Dye Capital”) (8) |

| 35,108,546 |

| 43.58 | % |

Marc Rubin (9) |

| 24,651,910 |

| 31.05 | % |

CRW Capital Cann Holdings LLC (“CRW”) (10) |

| 24,604,710 |

| 31.01 | % |

Dye Capital Cann Holdings II, LLC (“Dye Cann II”) (11) |

| 20,722,310 |

| 27.46 | % |

Dye Capital Cann Holdings, LLC (“Dye Cann I”) (12) | | 9,475,000 | | 17.25 | % |

Brian Ruden (13) | | 9,846,934 | | 15.27 | % |

Naser A. Joudeh (14) | | 9,510,406 | | 14.80 | % |

James E. Parco (15) | | 2,899,262 | | 5.28 | % |

| | | | | |

* | Less than 1% |

| (1) | Represents 148,710 shares of common stock held by Mr. Dye, 1,500,000 shares of common stock underlying options that have vested held by Mr. Dye, 9,287,500 shares of common stock and 187,500 shares of common stock underlying warrants held by Dye Cann I, 4,911,236 shares of common stock issuable upon conversion of Series A Preferred Stock held by Dye Capital, and 20,722,310 shares of common stock issuable upon conversion of Series A Preferred Stock held by Dye Cann II. Mr. Dye has voting and investment control over the shares of common stock beneficially owned by Dye Capital, Dye Cann I and Dye Cann II. Mr. Dye disclaims beneficial ownership of the shares held by Dye Capital, Dye Cann I and Dye Cann II except to the extent of his pecuniary interest therein. |

| (2) | Represents 87,701 shares of common stock held by Mr. Cozad, 24,604,710 shares of common stock issuable upon conversion of Series A Preferred Stock held by CRW, and 117,999 shares of common stock issuable upon conversion of the Convertible Notes owned by Cozad Investments, L.P. (“Cozad Investments”). CRW Capital, LLC (“CRW Capital”) is the manager of CRW and has voting and investment control over the shares beneficially owned by CRW. Jeffrey Cozad and Marc Rubin are co-managers of CRW Capital and share voting and investment control over the shares beneficially owned by CRW. Mr. Cozad maintains voting and investment control over the shares of common stock beneficially owned by Cozad Investments. Mr. Cozad disclaims beneficial ownership of the shares held by CRW and Cozad Investments except to the extent of his pecuniary interest therein. |

| (3) | Represents 85,695 shares of common stock, 1,715,936 shares of common stock underlying warrants, and 8,045,303 shares of common stock issuable upon conversion of Series A Preferred Stock. Mr. Ruden resigned as a director effective as of October 28, 2022. |

| (4) | Represents 54,680 shares of common stock, 193,929 shares of common stock underlying warrants, and 1,005,542 shares of common stock issuable upon conversion of Series A Preferred Stock. |

| (5) | Represents shares of common stock underlying options that have vested. |

| (6) | Represents 273,657 shares of common stock and 141,599 shares of common stock issuable upon conversion of the Convertible Notes owned by Mr. Garwood. |

8

| (7) | Represents (i) 87,701 shares of common stock held by Mr. Mukharji, (ii) 39,368 shares of common stock held by Magnolia Hall Enterprises, LLC, and (iii)94,400 shares of common stock issuable upon conversion of the Convertible Notes owned by Mr. Mukharji. Mr. Mukharji has voting and investment control over the shares of common stock held by Magnolia Hall Enterprises, LLC. |

| (8) | Represents 4,911,236 shares of common stock issuable upon conversion of shares of Series A Preferred Stock held by Dye Capital, 9,287,500 shares of common stock held by Dye Cann I, 187,500 shares of common stock issuable upon exercise of warrants held by Dye Cann I, and 20,722,310 shares of common stock issuable upon conversion of shares of Series A Preferred Stock held by Dye Cann II. Dye Capital is the manager of each of Dye Cann I and Dye Cann II and has voting and investment control over the shares beneficially owned by Dye Cann I and Dye Cann II. Justin Dye is the general partner of Dye Capital and has voting and investment control over the shares beneficially owned by Dye Capital and, indirectly, over the shares beneficially owned by Dye Cann I and Dye Cann II. Dye Capital disclaims beneficial ownership of the shares beneficially owned by Dye Cann I and Dye Cann II except to the extent of its pecuniary interest therein. Mr. Dye disclaims beneficial ownership of the shares beneficially owned by Dye Capital, Dye Cann I and Dye Cann II except to the extent of his pecuniary interest therein. Dye Capital, Dye Cann I and Dye Cann II’s address is 350 Camino Gardens Blvd, Suite 200, Boca Raton, FL 33432. |

| (9) | Represents shares of common stock issuable upon conversion of shares of Series A Preferred Stock held by CRW and 47,200 shares of common stock issuable upon conversion of the Convertible Notes owned by The Rubin Revocable Trust U/A/D 05/09/2011 (the “Rubin Trust”). Marc Rubin is a majority owner of the Rubin Trust. The Company does not know if Mr. Rubin shares voting and investment power over the securities held by the Rubin Trust. CRW Capital is the manager of CRW and has voting and investment control over the shares beneficially owned by CRW. Jeffrey Cozad and Marc Rubin are co-managers of CRW Capital and share voting and investment control over the shares beneficially owned by CRW. Mr. Rubin disclaims beneficial ownership of the shares held by CRW and the Rubin Trust except to the extent of his pecuniary interest therein. Mr. Rubin’s address is 4740 W. Mockingbird Lane, P.O. Box 195579, Dallas, Texas 75209. Mr. Rubin was appointed to the Board to fill the vacancy created by Mr. Ruden’s resignation effective as of October 28, 2022. |

| (10) | Represents shares of common stock issuable upon conversion of Series A Preferred Stock held by CRW. CRW Capital is the manager of CRW and has voting and investment control over the shares beneficially owned by CRW. Jeffrey Cozad and Marc Rubin are co-managers of CRW Capital and share voting and investment control over the shares beneficially owned by CRW. CRW Capital and Messrs. Cozad and Rubin disclaim beneficial ownership of the shares held by CRW except to the extent of their respective pecuniary interest therein. The address for CRW, CRW Capital and Mr. Rubin is 4740 W. Mockingbird Lane, P.O. Box 195579, Dallas, Texas 75209. |

| (11) | Represents 20,722,310 shares of common stock issuable upon conversion of Series A Preferred Stock held by Dye Cann II. Dye Capital and Mr. Dye have voting and investment control over the shares of common stock beneficially owned by Dye Cann II as described above. Dye Capital and Mr. Dye disclaim beneficial ownership of the shares held by Dye Cann II except to the extent of their respective pecuniary interest therein. Dye Cann II’s address is 350 Camino Gardens Blvd, Suite 200, Boca Raton, FL 33432. |

| (12) | Represents 9,287,500 shares of common stock and 187,500 shares of common stock underlying warrants. Dye Capital and Mr. Dye have voting and investment control over the shares of common stock beneficially owned by Dye Cann I as described above. Dye Capital and Mr. Dye disclaim beneficial ownership of the shares held by Dye Cann I except to the extent of their respective pecuniary interest therein. Dye Cann I’s address is 350 Camino Gardens Blvd, Suite 200, Boca Raton, FL 33432. |

| (13) | Represents 85,695 shares of common stock, 1,715,936 shares of common stock underlying warrants, and 8,045,303 shares of common stock issuable upon conversion of Series A Preferred Stock. |

| (14) | Represents (i) 560,662 shares of common stock underlying warrants and 2,822,505 shares of common stock issuable upon conversion of Series A Preferred Stock held by Mr. Joudeh and (ii) 991,795 shares of common stock underlying warrants and 5,135,444 shares of common stock issuable upon conversion of Series A Preferred Stock held by his spouse in her name and a wholly owned limited liability company. Mr. Joudeh and his spouse share voting and investment power over these securities. The address of Mr. Joudeh and his spouse is 16836 E. Weaver Pl., Aurora, CO 80016. |

| (15) | Represents 1,421,887 shares of common stock and 200,000 shares of common stock underlying options that have vested held by James E Parco and 1,277,375 shares of common stock held by his spouse, Pamela S. Parco. The Company does not know if Mr. Parco and his spouse share voting and investment power over these securities. The address of Mr. Parco and his spouse is P.O. Box 324, Palmer Lake, CO 80133. |

9

The following table sets forth, based on 86,050 shares of our Series A Preferred Stock outstanding as of October 5, 2022 (which excludes certain shares of Series A Preferred Stock held in escrow or otherwise issuable or releasable in connection with consummated mergers and acquisitions), certain information as to the stock ownership of each person known by us to own beneficially more than five percent or more of the Series A Preferred Stock, of each of the NEOs included in the Summary Compensation Table, of our directors, and of all our current executive officers and directors as a group. The table below does not include 944 shares of Series A Preferred Stock that are held in escrow under the asset purchase agreements entered into with the Star Buds Companies, which are not outstanding as of the Record Date nor entitled to vote at the Annual Meeting.

Unless otherwise indicated, the address of each of the following beneficial owner is c/o Medicine Man Technologies, Inc., 4880 Havana Street, Suite 201, Denver, CO 80239. All beneficial ownership is direct and the beneficial owner has sole voting and investment power over the securities beneficially owned unless otherwise noted.

| | | | | |

|

| Number of |

| |

|

| | Shares of | | Percent of |

|

| | Beneficially | | Outstanding |

|

Name of Beneficial Holder | | Owned | | Class |

|

NEOs & Directors | | | | | |

Justin Dye (NEO, Director) (1) |

| 26,410 |

| 30.69 | % |

Jeffrey Cozad (Director) (2) |

| 25,350 |

| 29.46 | % |

Brian Ruden (Director) |

| 8,289 |

| 9.63 | % |

Salim Wahdan (Director) |

| 1,036 |

| 1.20 | % |

Nirup Krishnamurthy (NEO, Director) | | — | | — | |

Daniel Pabon (NEO) | | — | | — | |

All Officers and Directors as a group (11 Persons) |

| 61,085 |

| 70.99 | % |

| | | | | |

5% or greater holders: |

| |

| | |

Dye Capital and Co. (3) |

| 26,410 |

| 30.69 | % |

Marc Rubin (4) |

| 25,350 |

| 29.46 | % |

CRW Capital Cann Holdings LLC (5) |

| 25,350 |

| 29.46 | % |

Dye Capital Cann Holdings II, LLC (6) |

| 21,350 |

| 24.81 | % |

Brian Ruden | | 8,289 | | 9.63 | % |

Naser A. Joudeh (7) | | 8,199 | | 9.53 | % |

| | | | | |

| (1) | Represents 21,350 shares of Series A Preferred Stock held by Dye Cann II and 5,060 shares of Series A Preferred Stock held by Dye Capital. Mr. Dye has voting and investment control over the shares beneficially owned by Dye Cann II and Dye Capital as described below. Mr. Dye disclaims beneficial ownership of the shares held by Dye Cann II and Dye Capital except to the extent of his pecuniary interest therein. |

| (2) | Represents 25,350 shares held by CRW. CRW Capital is the manager of CRW and has voting and investment control over the shares beneficially owned by CRW. Jeffrey Cozad and Marc Rubin are co-managers of CRW Capital and share voting and investment control over the shares beneficially owned by CRW. CRW Capital and Messrs. Cozad and Rubin disclaim beneficial ownership of the shares held by CRW except to the extent of their respective pecuniary interest therein. The address for CRW, CRW Capital and Mr. Rubin is 4740 W. Mockingbird Lane, P.O. Box 195579, Dallas, Texas 75209 |

| (3) | Represents 5,060 shares of Series A Preferred Stock held by Dye Capital and 21,350 shares of Series A Preferred Stock held by Dye Cann II. Dye Capital is the manager of Dye Cann II and has voting and investment control over the shares beneficially owned by Dye Cann II. Justin Dye is the general partner of Dye Capital and has voting and investment control over the shares beneficially owned by Dye Capital and, indirectly, over the shares beneficially owned by Dye Cann II. Dye Capital disclaims beneficial ownership of the shares beneficially owned by Dye Cann II except to the extent of its pecuniary interest therein. Mr. Dye disclaims beneficial ownership of the shares beneficially owned by Dye Capital and Dye Cann II except to the extent of his pecuniary interest therein. Mr. Dye, Dye Capital and Dye Cann II’s address is 350 Camino Gardens Blvd, Suite 200, Boca Raton, FL 33432. |

| (4) | Represents 25,350 shares held by CRW. CRW Capital is the manager of CRW and has voting and investment control over the shares beneficially owned by CRW. Jeffrey Cozad and Marc Rubin are co-managers of CRW Capital and |

10

| share voting and investment control over the shares beneficially owned by CRW. CRW Capital and Messrs. Cozad and Rubin disclaim beneficial ownership of the shares held by CRW except to the extent of their respective pecuniary interest therein. The address for CRW, CRW Capital and Mr. Rubin is 4740 W. Mockingbird Lane, P.O. Box 195579, Dallas, Texas 75209. |

| (5) | CRW Capital is the manager of CRW and has voting and investment control over the shares beneficially owned by CRW. Jeffrey Cozad and Marc Rubin are co-managers of CRW Capital and share voting and investment control over the shares beneficially owned by CRW. CRW Capital and Messrs. Cozad and Rubin disclaim beneficial ownership of the shares held by CRW except to the extent of their respective pecuniary interest therein. The address for CRW, CRW Capital and Mr. Rubin is 4740 W. Mockingbird Lane, P.O. Box 195579, Dallas, Texas 75209. |

| (6) | Dye Capital is the manager of Dye Cann II and has voting and investment control over the shares beneficially owned by Dye Cann II. Mr. Dye is the general partner of Dye Capital and has voting and investment control over the shares held by Dye Capital and, indirectly, over the shares held by Dye Cann II. Dye Capital disclaims beneficial ownership of the shares beneficially owned by Dye Cann II except to the extent of its pecuniary interest therein. Mr. Dye disclaims beneficial ownership of the shares beneficially owned by Dye Capital and Dye Cann II except to the extent of his pecuniary interest therein. Dye Capital and Dye Cann II’s address is 350 Camino Gardens Blvd, Suite 200, Boca Raton, FL 33432. |

| (7) | Represents 2,908 shares held by Mr. Joudeh and 5,291 shares held by his spouse in her name and a wholly owned limited liability company. Mr. Joudeh and his spouse share voting and investment power over these securities. The address of Mr. Joudeh and his spouse is 16836 E. Weaver Pl., Aurora, CO 80016. |

11

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

At the Annual Meeting, the Board of Directors will submit to the stockholders for nomination each of Jonathan Berger, Jeffrey Cozad, Jeffrey Garwood, Paul Montalbano, and Salim Wahdan for election as Class A directors for a two-year term expiring at the Company’s 2024 annual meeting. Each nominee, if elected, will serve until the expiration of his respective term and until a quorumsuccessor is present.elected and qualified, or until his earlier death, resignation or removal. All nominees are members of the present Board of Directors.

What are my voting choices when voting onThe Board of Directors recommends a vote FOR the director nominees, and whatnominees. The persons named in the accompanying proxy card will vote is needed to elect directors?

When voting onfor the election of directorthe nominees named in this proxy statement unless stockholders specify otherwise in their proxies. If any nominee at the time of election is unable to serve, until the 2019 Annual Meeting of Stockholders and until their successors are elected, you may:

A nominee is elected to the Board if a plurality of votes cast in the election of directors is cast “for” the nominee. Any votes withheld will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of the proposal. In the event that any nominee for directorotherwise is unavailable for election, and if other nominees are designated by the Board may either reduceof Directors, the number of directors or choose apersons named as proxy holders on the accompanying proxy card intend to vote for such substitute nominee. If the Board chooses a substitute nominee, the shares represented by a proxy will be voted for the substitute nominee, unless other instructions are given in the proxy.

The Board recommends that the stockholders vote “FOR” allnominees. Management is not aware of the nominees.existence of any circumstance which would render the nominees named below unavailable for election.

What vote is required to approve each Proposal?

Proposal No. l. Election of Directors. The election of each director nominee requiresSet forth below are the affirmative vote of a pluralitynames, ages, and biographical information of the votes cast, if a quorum is present, in the election of directors.

Proposal No. 2. Ratification of Auditors. An affirmative vote of a majoritynominees for Class A directors of the votes cast at the Meeting, ifCompany.

Jonathan Berger, 63, has served as a quorum is present, is required for ratificationdirector since December 2021. Mr. Berger previously served as CEO and director of the selection of BF Borgers CPA PC as independent auditors for the fiscal year ending December 31, 2017.

Proposal No. 3. To approve an Agreement and Plan of Merger, dated as of February 27, 2017, by and between Medicine Man Technologies, Inc., Medicine Man Consulting,Great Lakes Dredge & Dock, Inc., a direct, wholly-owned subsidiaryNasdaq listed company. Mr. Berger also served on the board of Medicine Man Technologies,directors of Boise Paper, Inc. and Pono Publications, Ltd. An affirmative vote of, a majorityNew York Stock Exchange listed company, where he also served as chair of the votes castaudit and compensation committees of the board of directors. Mr. Berger is currently a member of the board of directors of Alloy, a privately-held specialty environmental contractor, and Partner with Genesis Business Humanity, a boutique advisory firm. Prior to his director and executive experience, Mr. Berger was a partner at KPMG, an international accounting and consulting firm, where he led KPMG’s national corporate finance practice. Mr. Berger has previously held a CPA license and securities licenses throughout his career after earning a BS in Human Development from Cornell University and an MBA from Emory University. Mr. Berger’s experience in senior leadership and directorships with both private and publicly-traded companies, as well as his robust financial background and previously-held certifications, qualifies him to serve on the Board.

Jeffrey Cozad, 58, has served as a director since March 2021. From 2007 to 2019, Mr. Cozad was a Managing Partner at Stonerise Capital Partners (“Stonerise Capital”), an investment management company in San Francisco, California that he co-founded in 2007. Beginning in January 2020, Mr. Cozad became Managing Partner Emeritus at Stonerise Capital. In October 2020, Mr. Cozad co-founded CRW, a special purpose vehicle created to support the Company’s vision of becoming one of the largest vertically integrated cannabis operators in Colorado. He is also the Managing Partner of his family office, Cozad Investments, which has completed more than 20 investments across a disparate set of industries over the past 13 years. Mr. Cozad holds an MBA from The University of Chicago Booth School of Business and received a BA in Economics and Management from DePauw University, where he served on the Board of Trustees for 10 years and also chaired the University’s endowment fund investment committee during his tenure on the Board of Trustees. We believe his significant experience with investments across a variety of industries qualifies him to serve on the Board.

Jeffrey Garwood, 60, has served as a director since September 2020. Mr. Garwood is the founder of, and since 2010 has been the managing member of, Liberation Capital, LLC, a private equity fund that is focused on providing modular, repeatable waste to value project finance. He is also the co-owner of, and since 2010 has actively managed, Zysense LLC, an entity providing high precision measurement instruments for research. Prior to founding Liberation Capital, Mr. Garwood held a variety of leadership positions with General Electric Company (“GE”), including President and CEO of GE Water and Process Technologies, President and CEO of GE Fanuc, and President of Garrett Aviation. Prior to joining Garret Aviation, Mr. Garwood worked at the Meeting, ifstrategic consulting firm McKinsey and Company. Mr. Garwood received a quorumB.S. of Chemical Engineering from North Carolina State University and an MBA from the Kenan-Flagler Business School at the University of North Carolina at Chapel Hill. Mr. Garwood brings 30 years of extensive business experience across finance and operational departments, and we believe this experience and Mr. Garwood’s qualifications across multiple industries qualifies him to serve on the Board.

Paul Montalbano, 55, has served as director since February 2022. Dr. Montalbano is present,a neurosurgeon in Boise, Idaho, where he actively practices as a partner at Neuroscience Associates, specializing in complex spinal reconstruction. Before

12

joining Neuroscience Associates in 2000, Dr. Montalbano completed his six-year residency at the University of South Florida located in Tampa, Florida. Dr. Montalbano received a Bachelor of Science from Loyola University of Chicago and his M.D. from Northwestern University. Since 2012, Dr. Montalbano has served on the board of Treasure Valley Hospital in Boise, ID, including service on the medical executive, governing, and financial committees of the board of Treasure Valley Hospital. He is required for approvalalso the director of this transaction.

Proposal No. 4 To approve a Share Exchange Agreement dated asneurosurgery and serves on the Neurosurgery Center of February 27, 2017, by and between Medicine Man Technologies, Inc., Success Nutrients, Inc.Excellence committee at Treasure Valley Hospital. The Company and the shareholdersBoard believe that Mr. Montalbano’s significant experience with private healthcare companies qualifies him to serve on the Board.

Salim Wahdan, 42, has served as a director since March 2021. Mr. Wahdan has nearly two decades of Success Nutrients, Inc. An affirmative voteentrepreneurial experience owning and operating retail businesses. During the last five years, Mr. Wahdan was a partner and operator of a majorityStar Buds in Adams, Louisville, and Westminster, several of the votes cast atStar Buds’ branded dispensaries the Meeting, if a quorum is present, is required for approvalCompany purchased between December 2020 and March 2021. During his tenure with Star Buds, Mr. Wahdan’s responsibilities included oversight and management of this transaction.

Proposal No. 5To approve the Company’s 2017 Equity Incentive Plan; An affirmative vote of a majorityoperations, accounting, inventory, and strategic growth of the votes cast atStar Buds retail dispensaries under his management, and he was instrumental in the Meeting, if a quorum is present, is required for approval of this Plan.

Proposal No. 6 To approve on an Advisory Basis the Compensation of Named Executive Officers. An affirmative vote of a majorityearly growth of the votes cast atStar Buds franchise. Prior to his time in the Meeting, if a quorum is present, is required for non-binding advisory approval ofcannabis industry, Mr. Wahdan owned and operated various retail concepts in Colorado. We believe Mr. Wahdan’s significant participation in the executive compensation of named executive officers.

Proposal No. 7 Frequency of Advisory Vote on Executive Compensation. An affirmative vote of a majority of the votes cast at the Meeting, if a quorum is present, is required for approvalcannabis industry coupled with his experience owning and operating retail concepts qualifies him to set the frequency of shareholder advisory vote on executive compensation.

What are my voting choices when voting on theratification of the appointment of BF Borgers CPA PC as our independent registered public accounting firm?

When votingserve on the ratification of the appointment of BF Borgers CPA PC as our independent registered public accounting firm, you may:Board.

Vote Required

The affirmative vote of a majority of the votes castshares present and entitled to vote at a meeting of stockholders at which a quorum is required for approval of the ratification of BF Borgers CPA PC. Abstentions will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of the proposal.

The Board recommends that the stockholders vote “FOR” the ratification of BF Borgers CPA PC.

What if I do not specify a choice for a matter when returning a proxy?

If you sign your proxy but do not give voting instructions, the individuals named as proxy holders on the proxy card will vote “FOR”present is necessary to approve the election of all nominees, “FOR”directors, with the ratificationholders of BF Borgers CPA PC, “FOR” approvalour common stock and the holders of our Series A Preferred Stock (which vote on an as-converted-to-common-stock basis) voting together as a single class is required to elect each Class A director included in this proposal. You may vote FOR or AGAINST any of the Pono and Success Nutrient Transactions, “FOR” the 2017 Equity Incentive Plan, “FOR” approve the compensationnominees or ABSTAIN from voting on any of the named executive officers and “FOR the frequency of advisory vote on executive compensation and in their discretion on anynominees. Banks, brokers or other matters that may properly come before the Meeting.

Will my shares be voted if Inominees do not provide my proxy orhave authority to vote at the Meeting?

If you do not provide your proxy or vote at the Meeting and you are a stockholder whosecustomers’ unvoted shares of Common Stock are registered directly in your name with our transfer agent (Globex Transfer), your shares of Common Stock will not be voted.

If you do not provide your proxy or vote at the Meeting and you are a stockholder whose shares of Common Stock are held by them in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Abstentions and broker non-votes with respect to any of the nominees will have the effect of a bank, brokerage firmvote AGAINST that nominee.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE AS DIRECTORS

13

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

Board Composition and Director Appointment Rights

Our Bylaws provide for a “staggered” or other nominee (i.e.,“classified” board of directors, whereby the directors of the Board are divided into two classes, Class A and Class B, respectively, each class consisting, as nearly as possible, of one-half of the total number of directors constituting the entire Board. Directors in “street name”), your nominee may vote your shares in its discretion oneach class are elected to approximately two-year terms expiring at the proposal to elect directorselection of their respective successors at alternating annual meetings of our stockholders. Currently, the size of the Board is set at nine and the proposals to ratify BF Borgers CPA PC, the Transactions and adoptionBoard consists of the Equity Incentive Plan. The election offive Class A directors and the ratification of our independent registered public accounting firm are “routine matters” on which nominees are permitted to vote on behalf of their clients if no voting instructions are furnished.

Who is soliciting my proxy, how is it being solicited and who pays the cost?

The Board is soliciting your proxy for the Meeting. The solicitation process is being conducted primarily by mail. However, proxies may also be solicited in person, by telephone, facsimile or other electronic means. We pay the cost of soliciting proxies and may use employees to solicit proxies and also reimburse stockbrokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the owners of our Common Stock.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means you have multiple accounts with our transfer agent, and to vote all your shares you will need to sign and return all proxy cards.

May stockholders ask questionsterms expiring at the Meeting?

Yes. At the endAnnual Meeting and four Class B directors with terms expiring at our 2023 annual meeting of the Meeting, our representatives will answer questions from stockholders.

PRINCIPAL SHAREHOLDERS

The following table sets forth certain information regarding the ownershipname, class, term and designating party of Common Stock as of April 30, 2017, by (i) each of our current directors:

Name | Class | Term | Designating Party | |||

Jonathan Berger | | A | | Expires 2022 annual meeting | | At Large |

Jeffrey Cozad | | A | | Expires 2022 annual meeting | | CRW |

Jeffrey Garwood | | A | | Expires 2022 annual meeting | | Dye Cann I |

Paul Montalbano | | A | | Expires 2022 annual meeting | | Dye Cann II |

Salim Wahdan | | A | | Expires 2022 annual meeting | | Brian Ruden and Naser Joudeh |

Justin Dye, Chairman | | B | | Expires 2023 annual meeting | | Dye Cann I |

Nirup Krishnamurthy | | B | | Expires 2023 annual meeting | | Dye Cann II |

Pratap Mukharji | | B | | Expires 2023 annual meeting | | Brian Ruden and Naser Joudeh |

Marc Rubin | | B | | Expires 2023 annual meeting | | Brian Ruden and Naser Joudeh |

The Company has granted rights to designated directors (ii)as follows:

| ● | Under the Securities Purchase Agreement, dated June 5, 2019, between the Company and Dye Cann I, as amended by the Amendment to Securities Purchase Agreement, dated July 15, 2019, the Amendment to Security Purchase Agreement, dated May 20, 2020, and the Consent, Waiver and Amendment, dated December 16, 2020 (as amended, the “Dye Cann I SPA”), until two years from the last closing under the Dye Cann I SPA, the Company is required to take all actions to ensure that two individuals designated by Dye Cann I shall be appointed to the Board. Currently, Justin Dye and Jeffrey Garwood serve as Dye Cann I’s designees on the Board. |

| ● | Under the letter agreement, dated December 16, 2020, between the Company and Dye Cann II, for as long as Dye Cann II owns, in the aggregate, at least $10,000,000 of the Series A Preferred Stock, as measured by a trailing 30 day volume weighted average price of the common stock, on an as-converted basis, or continues to hold at least 10,000 shares of Series A Preferred Stock, the Company is required to take all actions to ensure that either one individual, if the Board consists of five or fewer members, or two individuals, if the Board consists of more than five members, designated by Dye Cann II shall be appointed to the Board. For so long as Dye Cann II is entitled to designate directors, each committee of the Board shall include at least one of the directors designated by Dye Cann II as a member or, if Dye Cann II so elects, as an observer. Currently, Nirup Krishnamurthy and Paul Montalbano serve as Dye Cann II’s designees on the Board. |

| ● | Under the letter agreement, dated February 26, 2021, between the Company and CRW, for as long as CRW owns, in the aggregate, at least $15,000,000 of Series A Preferred Stock (calculated on an as-converted basis based on |

14

| the volume weighted average price of the Company’s common stock over a 30-day period) or continues to hold at least 15,000 shares of Series A Preferred Stock, the Company is required to take all actions to ensure that one individual designated by CRW will be appointed to the Board. For as long as CRW has the right to designate a director, each committee of the Board shall include the CRW designee as a member or, if CRW so elects, as an observer. Currently, Jeffrey Cozad serves as CRW’s designee on the Board. |

| ● | Under the Omnibus Amendment No. 2 to Asset Purchase Agreements, dated December 17, 2020, among the Company and the sellers party thereto (the “Star Buds Agreement”), for as long as the Sellers (as defined in the Star Buds Agreement) and the Members (as defined in the Star Buds Agreement) meet a specified ownership threshold, the Company shall recommend to its Board that Brian Ruden and Naser Joudeh jointly be permitted to designate three directors for appointment to the Board if the Board consists of seven or more members. Currently, Pratap Mukharji, Marc Rubin, and Salim Wahdan serve as Messrs. Ruden and Joudeh’s designees on the Board. |

Information about Directors Not Up for Reelection

Set forth below are the names, ages, and biographical information of the Company’s directors, other than the nominees for Class A directors of the Company (which are described above).

Justin Dye, 50, was named Chief Executive Officer and Executive Chairman of the Company in December 2019 and has served as a director and Chairman since June 2019. Mr. Dye has 25 years of experience in private equity, general management, operations, strategy, corporate finance, and mergers and acquisitions. In 2018, Mr. Dye founded Dye Capital, a private equity firm investing in growth companies in disruptive industries and a substantial beneficial owner of the Company’s stock. Prior to forming Dye Capital, Mr. Dye served as an integral part of the private equity consortium that acquired the grocery store chain Albertsons Companies (“Albertsons”), and led its expansion through over $40 billion in acquisitions, divestitures, and real estate and financing transactions. During his 11-year tenure as Chief Strategy Officer, Chief Operating Officer, and Chief Administration Officer at Albertsons, the company grew sales from approximately $10 billion to over $60 billion with over 2,300 stores and 285,000 employees. Prior to Albertsons, Mr. Dye held roles at Cerberus Capital Management, General Electric and Arthur Andersen. He also serves as lead director for New Seasons Market and is a member of the DePauw University Board of Trustees. Mr. Dye’s financial and executive experience qualifies him to serve on our Board of Directors.

Nirup Krishnamurthy, 60, was named President of the Company in October 2022 following his appointment as Chief Operating Officer of the Company in September 2020 and appointment to the Board in December 2021. He had previously served as the Company’s Chief Information and Integration Officer since June 2019; Mr. Krishnamurthy provided such service as a consultant until March 1, 2020, at which time he began formal employment with the Company. Mr. Krishnamurthy has over 25 years of experience in innovation, technology, restructuring, and M&A for Fortune 500 companies. Since May 2018, Mr. Krishnamurthy has been a partner with Dye Capital, a private equity firm investing in growth companies in disruptive industries. In addition to his work with Dye Capital, Mr. Krishnamurthy previously served as managing director of EBIT+ LLC (“EBIT+”), a management consulting firm he founded in January 2016; EBIT+ works with executive officers,management to improve revenues and (iii) allmargins while reducing operating costs. From September 2011 through December 2015, Mr. Krishnamurthy was EVP and Chief Strategy Officer & Chief Information Officer with The Great Atlantic and Pacific Tea Company (“A&P”), a grocery store chain, where he was responsible for the information services, digital commerce, supply chain & logistics, strategic sourcing and retail space planning functions for A&P. Mr. Krishnamurthy has also held senior management positions with companies including Northern Trust Corporation and United Airlines, Inc. He obtained a Ph.D. in Industrial Engineering Operations Research and a M.S. in Industrial Engineering Operations/Production Management from the State University of New York, and a B.S. in Mechanical Engineering from Anna University in Chennai, India. Mr. Krishnamurthy’s experience advising, managing and overseeing multiple companies, including companies in other highly-regulated industries, qualifies him to serve on our Board.

Pratap Mukharji, 62, has served as a director since February 2022. He previously served as one of our directors from January 2021 until December 2021. Prior to joining the Company, Mr. Mukharji was a senior partner and executive officersdirector at Bain & Company, a global management consulting company, from 2015 to 2020, leading its Supply Chain and Service Operations practice. Since retirement in 2020, Mr. Mukharji has been an Executive in Residence at the Fuqua School of Business at Duke University. With a concentration of experience in Industrial and Retail industries, Mr. Mukharji has led

15

corporate efforts focused on strategy, mergers and acquisitions, transformation and turnaround, operational improvement, due diligence, omnichannel, and e-commerce efforts across multiple industries. Prior to his time with Bain & Company, Mr. Mukharji was at Kearney and Booz-Allen & Hamilton. Mr. Mukharji received a BA in Economics from Haverford College at which he was Phi Beta Kappa, and an MBA from the Fuqua School of Business at Duke University at which he was a Fuqua Scholar. During his career, Mr. Mukharji has examined small and large capitalized companies and advised them on growth strategies and opportunities. We believe Mr. Mukharji’s significant experience through consulting work analyzing company financial statements and performing due diligence qualifies him to serve on our Board of Directors.

Marc Rubin, 49, has served as a group. Unless otherwise indicated, all sharesdirector since October 2022. Mr. Rubin has 20+ years of financing and investment experience from both public and private markets. Mr. Rubin currently serves as Managing Partner of Revity Capital Partners, LLC, a private equity firm focused on lower- to middle-market partnership-oriented transactions. Prior to joining Revity Capital Partners, Mr. Rubin was a Partner in the investment group Triarii Capital Management from 2015-2018, which focused on opportunistic, value-oriented investments. Mr. Rubin also served as a Partner and Investment Committee Member of Stonerise Capital for six years, and he served as a senior deal manager at Parthenon Capital, a middle-market buyout firm, for eight years. Mr. Rubin also co-owns CRW Capital, the manager of CRW, which is a special purpose vehicle created to support the Company’s vision of becoming one of the largest vertically integrated cannabis operators in Colorado. Mr. Rubin holds an MBA from Stanford Business School and received a BA in Economics from Colby College. Mr. Rubin’s depth of experience in investing, capital raising, and opportunistic acquisitions across diverse industries and markets qualifies him to serve on the Board.

Independence of Directors

Our Board has affirmatively determined that Messrs. Berger, Cozad, Garwood, Mukharji, and Montalbano are owned directlyeach independent within the meaning of the Nasdaq Listing Rules and the indicated personOTCQX Rules for U.S. Companies. The Board currently has sole votingfour members on its Audit Committee, and investment power. Included in the table are shares of our Common Stock that underlie outstanding options that mayall members were determined to be exercised over the next year.

Title of Class | Name and Address Of Beneficial Owner | Amount and Nature Of Beneficial Ownership | Percent Of Class | |||||||||

| Common | Andrew Williams(1)(2) 4880 Havana Street Suite 201 Denver, Colorado 80239 | 1,675,500 | 16% | |||||||||

| Common | Peter Williams 4880 Havana Street Suite 201 Denver, Colorado 80239 | 1,766,975 | 16.9% | |||||||||

| Common | Michelle Zeman 4880 Havana Street Suite 201 Denver, Colorado 80239 | 760,000 | 7.3% | |||||||||

| Common | Brett Roper(1) 4880 Havana Street Suite 201 Denver, Colorado 80239 | 164,000 | 1.6% | |||||||||

| Common | Paul Dickman(1) 4880 Havana Street Suite 201 Denver, Colorado 80239 | 55,000 | * | |||||||||

Common | James S. Toreson(1)(3) 4880 Havana Street Suite 201 Denver, Colorado 80239 | 25,000 | * | |||||||||

| Common | All Officers and Directors As a Group (4 persons) | 1,977,661 | 18.9% | |||||||||